TAX DISPARITIES IN PAKISTAN – STRICLTY AGAINST THE ISLAMIC PRINCIPLES OF EQUALITY

admin March 4, 2024

TAX DISPARITIES IN PAKISTAN – STRICLTY AGAINST THE ISLAMIC PRINCIPLES OF EQUALITY

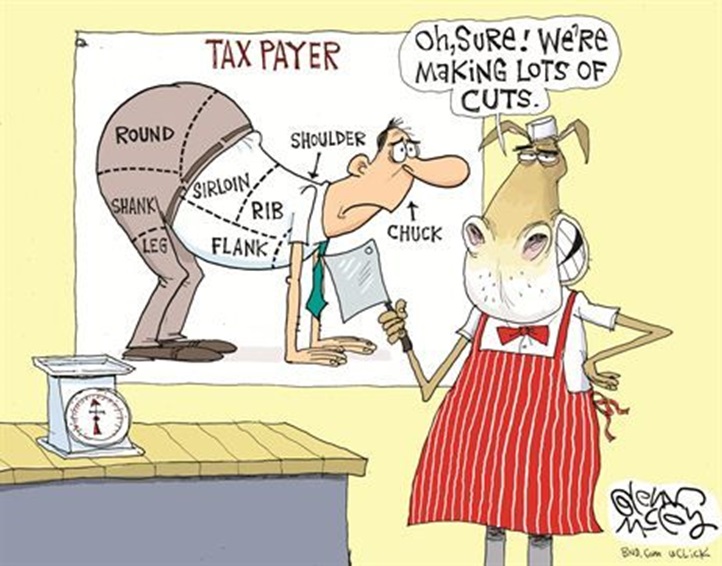

In the last 5 years, the salaried class has felt the brunt of higher taxes and currency devaluation. Earning PKR 3mn in 2019 was like $21,000, but in 2024, it’s just $9,000 a 60% drop. Taxes on salaries have surged, doubling, or even tripling for lower income brackets.

Salary (PKR/Annum) | FY19 | FY24 | Change |

Tax/Annum | Tax/Annum | % | |

400,000 | 0 | 0 | |

800,000 | 1,000 | 5,000 | 400% |

1,200,000 | 2,000 | 15,000 | 650% |

1,800,000 | 30,000 | 90,000 | 200% |

2,400,000 | 60,000 | 165,000 | 175% |

3,000,000 | 140,000 | 300,000 | 114% |

3,600,000 | 230,000 | 435,000 | 89% |

4,800,000 | 450,000 | 765,000 | 70% |

6,000,000 | 690,000 | 1,095,000 | 59% |

9,000,000 | 1,340,000 | 2,145,000 | 60% |

12,000,000 | 2,090,000 | 3,195,000 | 53% |

18,000,000 | 3,590,000 | 5,295,000 | 47% |

24,000,000 | 5,090,000 | 7,395,000 | 45% |

36,000,000 | 8,090,000 | 11,595,000 | 43% |

48,000,000 | 11,090,000 | 15,795,000 | 42% |

60,000,000 | 14,090,000 | 19,995,000 | 42% |

90,000,000 | 21,590,000 | 30,495,000 | 41% |

120,000,000 | 29,090,000 | 40,995,000 | 41% |

Last year, the salaried class paid PKR 264bn in taxes, whereas tax collection from Wholesale & Retail trade, accounting for a mammoth 18% of GDP, amounted to a mere PKR 15bn. Tax collection from exporters was also notably low at PKR 75 bn.

Comparison of after-tax income in $ terms

| After Tax Income in USD/ Annum | ||

| FY19 | FY24 | Change |

(PKR/Annum) | USD/Annum | USD/Annum | % |

400,000 | 2,935 | 1,333 | -55% |

800,000 | 5,864 | 2,650 | -55% |

1,200,000 | 8,792 | 3,950 | -55% |

1,800,000 | 12,989 | 5,700 | -56% |

2,400,000 | 17,172 | 7,450 | -57% |

3,000,000 | 20,988 | 9,000 | -57% |

3,600,000 | 24,731 | 10,550 | -57% |

4,800,000 | 31,923 | 13,450 | -58% |

6,000,000 | 38,968 | 16,350 | -58% |

9,000,000 | 56,214 | 22,850 | -59% |

12,000,000 | 72,726 | 29,350 | -60% |

18,000,000 | 105,749 | 42,350 | -60% |

24,000,000 | 138,773 | 55,350 | -60% |

36,000,000 | 204,820 | 81,350 | -60% |

48,000,000 | 270,868 | 107,350 | -60% |

60,000,000 | 336,915 | 133,350 | -60% |

90,000,000 | 502,034 | 198,350 | -60% |

120,000,000 | 667,153 | 263,350 | -61% |

As reported in the News International on March 3, 2024, IMF has asked the Government of Pakistan to levy 18% Federal Sales Tax on supply of Petroleum products, medicines, unprocessed food & stationery items. Levy of sales tax on these essential items will have spiralling effects on inflation. This has been proposed despite specific knowledge / data about the undocumented sectors. Below data is evident of the lack of seriousness of the IMF to actually bring tax reforms in Pakistan:

- As of Dec 2022, there were 7mn+ Cars registered in Pakistan whereas total filers as on Feb 2024 are only 3.5 million.

- There are 4million+ industrial & commercial utility connections in Pakistan, however, no. of sales tax registered persons are merely around 200,000 i.e. around 3.8 million [though identified] are purposely out of the tax net.

- As per March 2022, there are 66mn+ registered bank accounts in Pakistan, however, the same figure does not correlate with number of filers in Pakistan

- Despite increasing impact of inflation coupled with increase in tax rates applicable to salaried class, IMF is once again asking Government to increase tax on salaried class despite the fact that the agriculture sector, with huge share in GDP, is not paying any share of tax to the Federal Government.

- Instead of promoting industrialization, IMF has been focusing on taxing the already taxed sectors, which has resulted in premature deindustrialization in Pakistan. Capital is being moved / transferred abroad in industries as well as manufacturing sectors in foreign countries including UAE. Surprisingly, UAE is keen in making investments in India. So indirectly, funds of Pakistani, which are being invested in UAE, are apparently being used for investment in India.

- Concern of the policy makers is just to increase tax without any broadening of the tax base. This goes against the saying of Hazrat Ali RadiAllahu Anhu, which has also been quoted by the UNDP in its 2002 Arab Human Development Report as “Your concern with developing the land should be greater than your concern for collecting taxes, for the latter can only be obtained by developing; whereas he who seeks revenue without development destroys the country and the people

- In Pakistan, gain on disposal of land [non-revenue generating asset] after holding period of 6 years is exempt from the levy of income tax whereas on the other hand, gain on disposal of shares of public / private / unlisted company is taxable irrespective of any holding period. Disposal of shares is being tax despite the fact that unlike land, industries also pay tax on profits, which forms part of the break up value resulting in increase in ultimate value of shares, which is then double taxed by way of capital gain tax at the time of disposal of these shares.

Points shared above represent some of the apparent disparities in Tax system in Pakistan. There are many more and that too in the knowledge of IMF as well as policy makers, however, instead of actual tax reforms, they apparently want to further squeeze those who are paying taxes so that the Pakistan remain a regular customer of IMF.