Pakistanis Pay Lowest Taxes in the World, Says Minister — But His Own Tax Records Tell a Different Story

admin August 18, 2025

Pakistanis Pay Lowest Taxes in the World, Says Minister — But His Own Tax Records Tell a Different Story

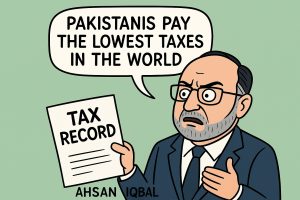

Federal Minister Ahsan Iqbal recently stated that “Pakistanis pay the lowest taxes in the world,” emphasizing that a strong economy rests on three pillars: taxes, exports, and foreign investment. He asserted that despite past failures, Pakistan now has an opportunity for “a new takeoff.”

According to him, fiscal reforms had generated Rs. 2,800 billion in financial space, allowing the government to finance Rs. 2,500 billion in defense spending. Yet, he admitted that exports remained weak and the country was still borrowing heavily to meet its day-to-day expenses.

The Minister’s Own Tax Record

Ironically, while the Minister has been urging Pakistanis to pay more taxes, data available on the Federal Board of Revenue (FBR) portal shows that Ahsan Iqbal himself paid a mere Rs. 82,440 in taxes during Tax Year 2016. To put this in perspective, even a salaried individual earning Rs. 125,000 per month contributes far more in annual taxes.

His declared tax contribution further declined in Tax Year 2019, when he paid just Rs. 55,656. Such figures raise questions about whether parliamentarians are serious about leading by example. Many observers point out that the taxes reflected in his record likely stemmed from indirect deductions—such as withholding tax on mobile phone bills—rather than voluntary compliance.

Why Pakistan is Falling Behind

Pakistan’s weak tax culture is not just the fault of ordinary citizens. The political elite, who enjoy the largest perks and privileges from the state, often contribute the least in direct taxation. Ministers, parliamentarians, and influential elites receive official residences, fleets of cars, fuel allowances, subsidized utilities, free medical facilities, foreign trips at state expense, and generous pensions. Yet, when it comes to paying back to the homeland in the form of income tax, their declared contributions remain negligible.

This hypocrisy stands in sharp contrast to global practices. In countries like the United States, United Kingdom, and even in developing economies such as India and Bangladesh, elected representatives are subject to strict public scrutiny of their tax records. Politicians there are expected to set the standard for compliance, not hide behind technical deductions.

In Pakistan, however, politicians repeatedly call for “broadening the tax base” and increasing taxes on salaried professionals, traders, and small businesses while quietly ensuring that their own wealth—often parked in real estate, agriculture, and foreign assets—remains shielded from effective taxation.

The result is a vicious cycle:

Ordinary citizens are squeezed with higher indirect taxes on fuel, electricity, and mobile usage.

Exporters and businesses struggle with inconsistent policies, facing levies that competitors in other countries are exempt from.

Politicians and elites, who should be setting an example, contribute only token amounts and then preach about patriotism and sacrifice.

Public Outrage and Growing Skepticism

This glaring contradiction has not gone unnoticed. Citizens increasingly question whether parliamentarians are making a mockery of the system by pressing ordinary people to shoulder ever-higher burdens, while they themselves contribute next to nothing.

Critics argue that this double standard is precisely why the Federal Board of Revenue has quietly stopped publishing the annual list of taxes paid by parliamentarians—a practice once hailed as a step toward transparency.

How can leaders demand sacrifices from the people when they are unwilling to set an example themselves? Until the ruling class starts paying its fair share, Pakistan will continue to lag behind other countries that prioritize accountability and equitable taxation.