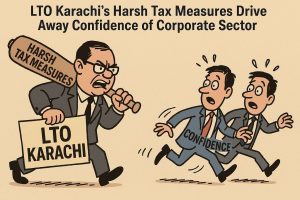

LTO Karachi’s Harsh Tax Measures Drive Away Confidence of Corporate Sector

admin July 26, 2025

Karachi: Once envisioned as a facilitative body for Pakistan’s largest corporate taxpayers, the Large Taxpayers Office (LTO) Karachi is now drawing criticism for alleged aggressive and coercive tactics aimed at forcefully meeting tax targets under challenging economic conditions.

Sources reveal that Zone-5 of LTO Karachi has recently withdrawn the valid withholding tax exemption certificate of a leading fertilizer manufacturing company—an entity that has consistently contributed over Rs. 20 billion annually to the national exchequer. The move, deemed unjustified by industry insiders, has sent shockwaves across the corporate sector.

Several other large taxpayers within the same zone are reportedly facing harassment through arbitrary tax notices, aggressive follow-ups, and threats of prosecution, arrest, and suspension of sales tax registration—despite being compliant and regularly audited. One of the affected companies has reported income tax refunds worth Rs. 11 billion as per its latest audited financials, yet is now being pressured to make additional payments instead of receiving its dues.

This deteriorating environment has sparked grave concerns among investors and professionals alike. “Who will invest in a country where legitimate taxpayers are treated like criminals?” questioned a senior tax advisor, who also revealed that a growing number of tax professionals are exploring opportunities abroad, particularly in Saudi Arabia and the UAE, due to escalating pressure and lack of respect from tax authorities.

Observers highlight that the tax department’s actions contradict the principles of fair and equitable taxation. Instead of targeting the vast undocumented economy, the department appears to be focusing disproportionately on the documented sector. Dozens of government-issued Honda City meant to support outreach efforts to identify undocumented businesses remain underutilized, as tax officers reportedly prefer operating from within their air conditioned offices.

Adding to concerns, insiders report that to meet revenue targets for FY2025, the department has already collected substantial advance taxes meant for FY2026—raising questions about the sustainability and integrity of current revenue collection practices.

The business community is now calling for urgent intervention by the Federal Board of Revenue (FBR) and the Ministry of Finance to ensure tax enforcement remains balanced, fair, and conducive to economic growth.