FBR – PERFORMANCE EVALUATION REPORT – MAJOR ISSUE

Author February 26, 2024

Federal Board of Revenue has published an annual appraisal report showing overall performance of FBR during the tax year 2023. The said report can be accessed at “2023121818121423230Annualreport2022-23published18Dec2023.pdf (fbr.gov.pk)”

However, there are major notable issues apparent from the face of the report, which can be used by the revenue authority to target tax collection from new taxpayers. Below are some of the major issues:

1. On page no. 17 of the report, it has been stated that 1,896,295 new taxpayers have been registered for income tax, therefore, total taxpayers registered for income tax have reached all time high of 11,768,041. On page no. 18 of the report, it has been stated that income tax filers are 3,938,502 out of total 11,768,041 i.e. 7,829,539 persons, despite having tax registration, have not filed their income tax return.

2. On page no. 17 of the report, it has been stated that 32,097 new taxpayers have been registered for Sales tax, therefore, total taxpayers registered for sales tax have reached 398,183. On page no. 18 of the report, it has been stated that sales tax filers are only 223,873 out of total 398,183 i.e. 174,310 persons, despite having tax sales tax registration, have not filed their sales tax returns.

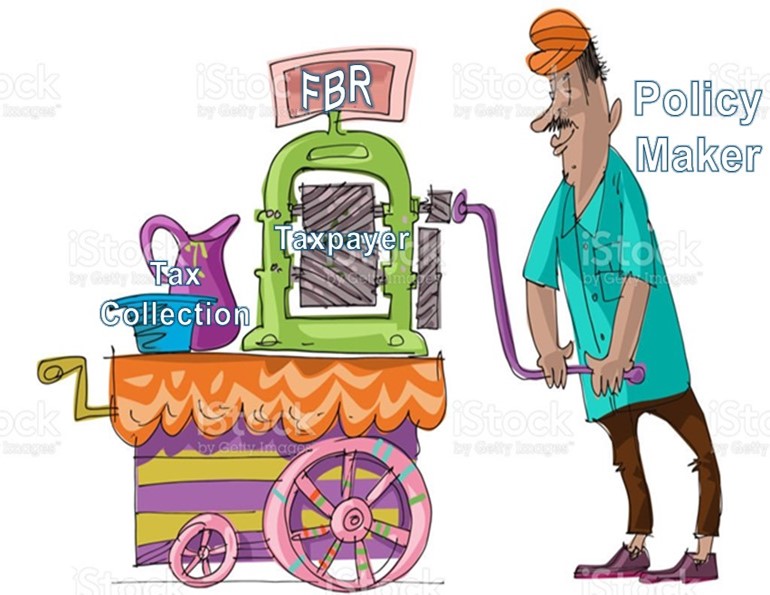

3. Surprisingly, despite all requisite data of Income tax / sales tax non-Filers, in the performance report, FBR has not stated a single step to ensure proper filing by these Income Tax and Sales Tax Non-Filers.

4. On page no. 19 of the report, it has been stated that “Broadening of Tax Base Business Intelligence Dashboard” has been fully automated. Surprisingly, despite fully automation of BTB dashboard, FBR is still struggling to bring in new taxpayers to the system and revenue is still being collected from existing taxpayers

5. On page no. 27 of the report, it has been stated that the average number of days of Income tax processing through IRIS system were 459 days. This is extremely surprising as the revenue authority took 459 days on average basis to process income tax refund after filing by the taxpayer. A taxpayer usually files income tax refund 6 months after a complete tax year is passed [at the time of filing of income tax refunds], thereafter refunds have been processed after a further delay of 459 days. With 22% plus finance cost, FBR is severely causing cash flow issues for genuine taxpayers. Moreover, 459 represents average number of days, so there may a situation where a refund of insignificant amount would have been processed within 10 days and a major refund would have been processed after a period of 918 days [around 3 years] making it an average of 459.

6. Above para represents average number of days of refunds which have been processed, there are numerous refunds which are pending since several years and have no where been reported even as a liability of the FBR.

7. Despite law to process exporters sales tax refunds within a period of 3 days from filing, FBR, on page 28 has stated that sales tax refunds through FASTER have been processed on an average of 90 days. This represents claims of 5 export oriented sectors that are processed through FASTER, however, there are many exporters other than these sectors and there refunds are pending since a very long time and have no where been reported.

8. On page 35 of the report, FBR has stated that Rs. 39.5 billions of tax demand has been raised through income tax audit, however, surprisingly, only 440 million has been collected out of total demand.

9. On page 36 of the report, FBR has stated that Rs. 8.5 billions of tax demand has been raised through sales tax audit, however, surprisingly, only 89 million has been collected out of total demand.